Salary Cap: The Rising Tide of non-QB Contracts

T.J. Watt inked the largest non-QB contract in NFL history last week

Last week, Steelers edge rusher T.J. Watt signed an extension with the Steelers through 2028. The deal extends Watt’s contract for three years at a cost to the Steelers of $123m. The contract has full guarantees for Watt’s earnings for what he was originally scheduled to make in 2024 ($21m) plus an additional $87m from his is $123m in new money.

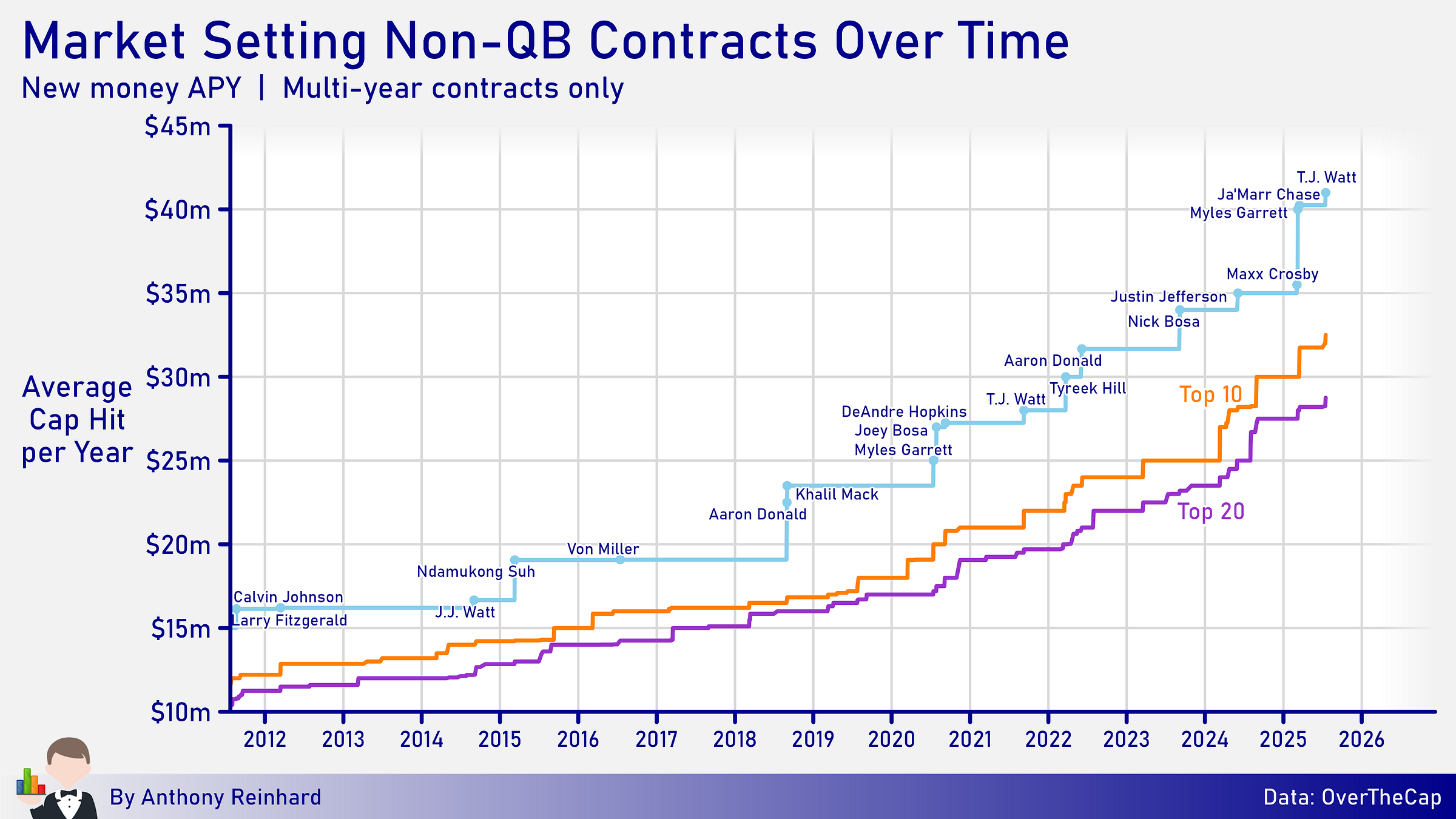

Watt’s new money APY (Average Per Year) of $41m sets a new high for non-QB contracts. It is the fourth time this offseason that the bar has been raised, which is the most we’ve seen since the 2011 CBA. Maxx Crosby was the first to exceed Justin Jefferson’s $35m APY in early March. Just a few days later, the Browns resolved Myles Garrett’s trade request with a monster $40m APY extension, $4.5m better than Crosby’s agreement. The next week, Ja'Marr Chase inched past Garrett, signing a deal worth $40.25m APY.

Below, you can see where the biggest non-QB contracts of all-time have stood at each point in time. Contract values are from OverTheCap.

Obviously we should expect market setting contracts to rise given the rapid increases of the NFL salary cap in recent years. Interestingly, T.J. Watt’s last extension in 2021 remains the highest ever in terms of new money APY % of cap at signing (15.3%), although it should be noted that Watt signed that deal during a temporary COVID-era salary cap drop. If we impute a salary cap in the low 200 million range for that season, Watt’s 2021 contract comes in around 13.7%, which is in line with DeAndre Hopkins’ market-setting APY from the prior offseason.

Only two non-QBs other than Watt have exceeded a new money APY greater than 15% of the cap: Aaron Donald in 2022 & Nick Bosa in 2023. With Watt’s new deal coming in at 14.7%, there may not be a ton of room to justify a player moving beyond $42m APY (15% of the 2025 salary cap) before the 2026 offseason.

Regardless, the jump made by Myles Garrett this summer (14.3%) has put the top of the market in a healthy place compared to Justin Jefferson’s $35m APY number from 2024 that would have amounted to just 12.5% of the 2025 cap. For eight years starting in 2012, Calvin Johnson’s $16.2m new money APY contract stood as the largest contract relative to the cap at 13.4%. Since Joey Bosa broke through that mark in 2020, the standard for the top of the market has risen to the 14% range.

Looking further down, Garrett Wilson agreed to a deal last week that slotted in as the 9th highest-paid non-QB contract of all time ($32.5m new money APY). Wilson drops to 10th thanks to Watt and now has an APY that is 79.3% of the market setter. This is pretty much right in line with what we’ve seen historically. The 20th highest new money APY as of this writing is Tee Higgins’ deal from March. Higgins $28.75m new money APY is 70.1% of Watt’s $41m. This has been right around the norm since the start of the 2018 season when Aaron Donald and Khalil Mack broke through the $20m APY barrier.